Blockchain technology has been likened to Internet technology: the World Economic Forum calls it the second generation of the internet, and terms like “word wide ledger” are in vogue. While internet tackled the problem of communication and information sharing, blockchain is tackling the problem of trust, something maybe even more profound to our socio-economic system.

Is it possible that in a world suffering from a trust bust – trust in the banking system, in politics, in government, and in big corporations is at an all-time low after the financial crisis – that we can revitalize societal trust thru a trust-reinforcing technology like blockchain? This might be a bit of too much tech-optimism, but that blockchain has the potential to change our socio-economic system for the better is believed by many.

Just like with the introduction of internet technology, when very few at the time could envision its application beyond email, so today we have a limited vision of how blockchain will impact our society beyond crypto-currencies. Imaging new use cases for the technology is something everyone in business and government should be doing. This blog aims to give some directions where to search for these use-cases. But before we do so, let’s have a look at the features of blockchain technology.

What is the tech-essence of Blockchain?

There are many good explanations about the working of Blockchain technology and we will therefor suffice here by summarising its main features:

- Cryptography is used to replace trust (“in cryptography we trust”)

- A distributed ledger creates redundancy and ensures that the system is tamper-proof

- Smart contracts can be added to the blockchain to automate transactions

- Permissioned blockchains are closed systems with some form of (centralised) governance.

These features ensure an immutable ledger, with the full history of assets and transactions, and with visibility to all. This combination of transparency, authenticity and immutability ensures that all transactions recorded on the blockchain can be trusted. By doing so blockchain technology reduces the need for individual trust and replaces it with systemic trust. This means that entities are who they say they are (as far as their public address is concerned), and that the assets they claim to own are really theirs.

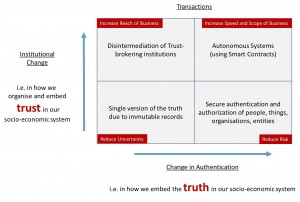

Four routes to game changing use cases

The technological features of blockchain unleash two forces of change that enable business transformation. The first force is organisational change, which is a direct result of the “trustless” nature of transactions on the blockchain. Trust is embedded in the technology and we therefore no longer need intermediaries to ensure trust. Processes can be streamlined by discarding steps that were included to increase and manage trust. The second force unleashed by blockchain technology is that of secure authentication. Using blockchain technology to manage identities and access, reduces the risk of online lives and business falling victim to identity fraud and intrusion.

We envision that the combination of these two forces gives us four application areas in which to search for game changing blockchain applications for individuals, business and government (click on chart).

- A single version of the truth

- Disintermediation of trust

- Autonomous systems

- Secure authorization and authentication

Don’t pave cow paths!

Blockchain use in these four application areas enables new business models and the reengineering of business processes within existing business models. This reengineering of business processes (BPR) reminds us of the introduction of Electronic Data Interchange (EDI) some 30 years ago. As then, be aware not to use the technology to automate the current way of working, but use the opportunity to rethink the way we do business. The warning “Do not pave cow paths”, issued by the fathers of BPR, Hammer & Champy, is as much applicable today as it was then. On a similar note, however, it really does not make sense to introduce blockchain in transactional systems that work efficiently and effectively. A final word of caution for tech-optimists (like myself): this technology, despite its trust infusing potential, is not going to solve the more fundamental problem of disengagement resulting from the rampant speed and complexity of digitisation.